18+ Assumable mortgage

An assumable mortgage is a mortgage loan that another borrower can take over while keeping the original terms and conditions. Chattel mortgage is a legal term used to describe a loan arrangement in which an item of movable personal property is used as security for the loan.

Infographic Benefits Of Fha Loans Infographicbee Com Fha Loans Debt To Income Ratio Fha

Great Lenders Reviewed By Nerdwallet.

. Compare Offers Side by Side with LendingTree. Well heres the good news. Ad Take Advantage Of Historically Low Mortgage Rates.

An assumable mortgage allows a buyer to take over or assume the sellers home loan. The buyer takes over the loans rate repayment period current principal balance. Once the loan is assumed by the buyer the seller is no longer responsible for repaying it.

In order words you are selling your house and. Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new mortgage. Ad Explore Quotes from Top Lenders All in One Place.

Get the Right Housing Loan for Your Needs. An assumable mortgage is a type of mortgage program that allows you to transfer your mortgage loan to the new buyer of your house. An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower.

We would like to show you a description here but the site wont allow us. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. An assumable mortgage is a mortgage that can be transferred from a seller to a buyer.

If the home is worth 200000 with 100000 left on the mortgage. Yet by December 1980 the average mortgage rate stood. Most likely you were looking for a website name and you have typed in this website address to see if its available.

Begin Your Loan Search Right Here. What is an adjustable-rate. An assumable mortgage allows someone to find a house they want to buy and take over the sellers existing home loan without applying for a new mortgage.

We would like to show you a description here but the site wont allow us. To put it simply an assumable mortgage loan is a type of financing arrangement that allows a homebuyer to take over the mortgage of the current seller. Assumable mortgages require a down payment relative to what is owed on the house and its overall value.

Assumable mortgages are types of mortgages that can be transferred to another party at the originally agreed-upon terms which include the. Typically this entails a home buyer taking over the. The movable property or.

How to assume a mortgage when buying a house.

18 Assumable Mortgage Tarantyjoan

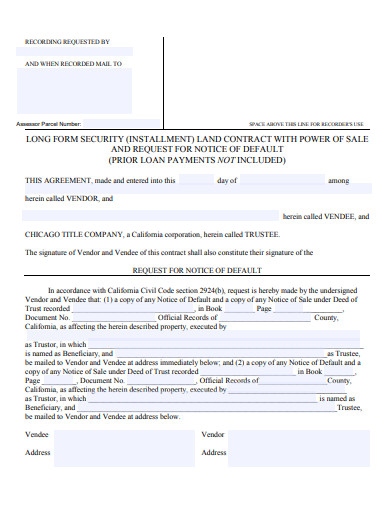

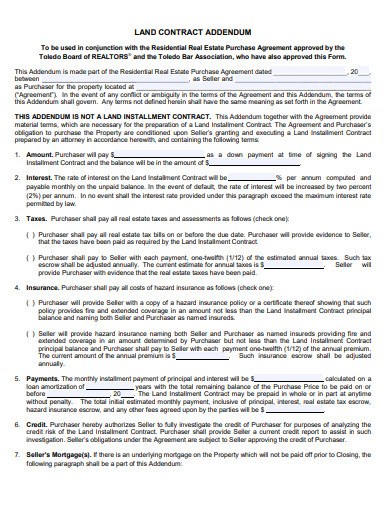

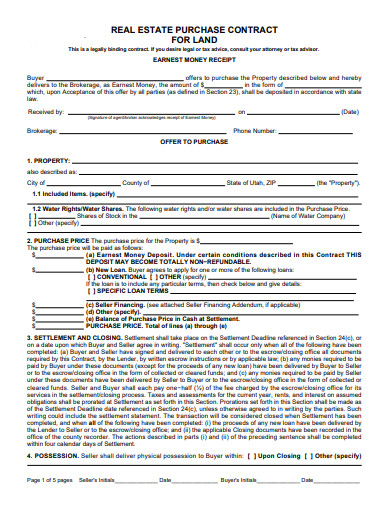

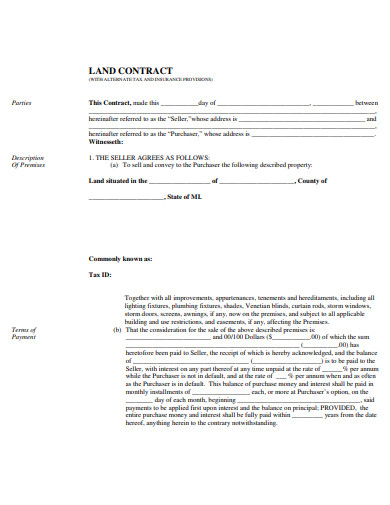

Land Contract Form 10 Examples Format Pdf Examples

2

Alisha Stockton Residential Real Estate Professional Home Facebook

2

Land Contract Form 10 Examples Format Pdf Examples

Sample Mortgage Promissory Note Notes Template Promissory Note Business Template

Benefits Of Buying A Home With A Va Mortgage Loan

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

Land Contract Form 10 Examples Format Pdf Examples

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha

Real Estate Glossary

Assumable Mortgage Real Estate Terms Interest Rate Rise Low Interest Rate

Alisha Stockton Residential Real Estate Professional Home Facebook

2

Land Contract Form 10 Examples Format Pdf Examples

New Cheat Sheet On Types Of Mortgages Enjoy Real Estate Infographic Mortgage Cheat Sheets